All about Bankruptcy Attorney Near Me Tulsa

People need to make use of Phase 11 when their financial debts surpass Chapter 13 debt limits. Chapter 12 insolvency is made for farmers and anglers. Phase 12 repayment plans can be extra versatile in Chapter 13.

The means test looks at your ordinary month-to-month revenue for the six months preceding your declaring date and contrasts it against the mean revenue for a similar house in your state. If your income is below the state mean, you automatically pass and do not have to finish the whole kind.

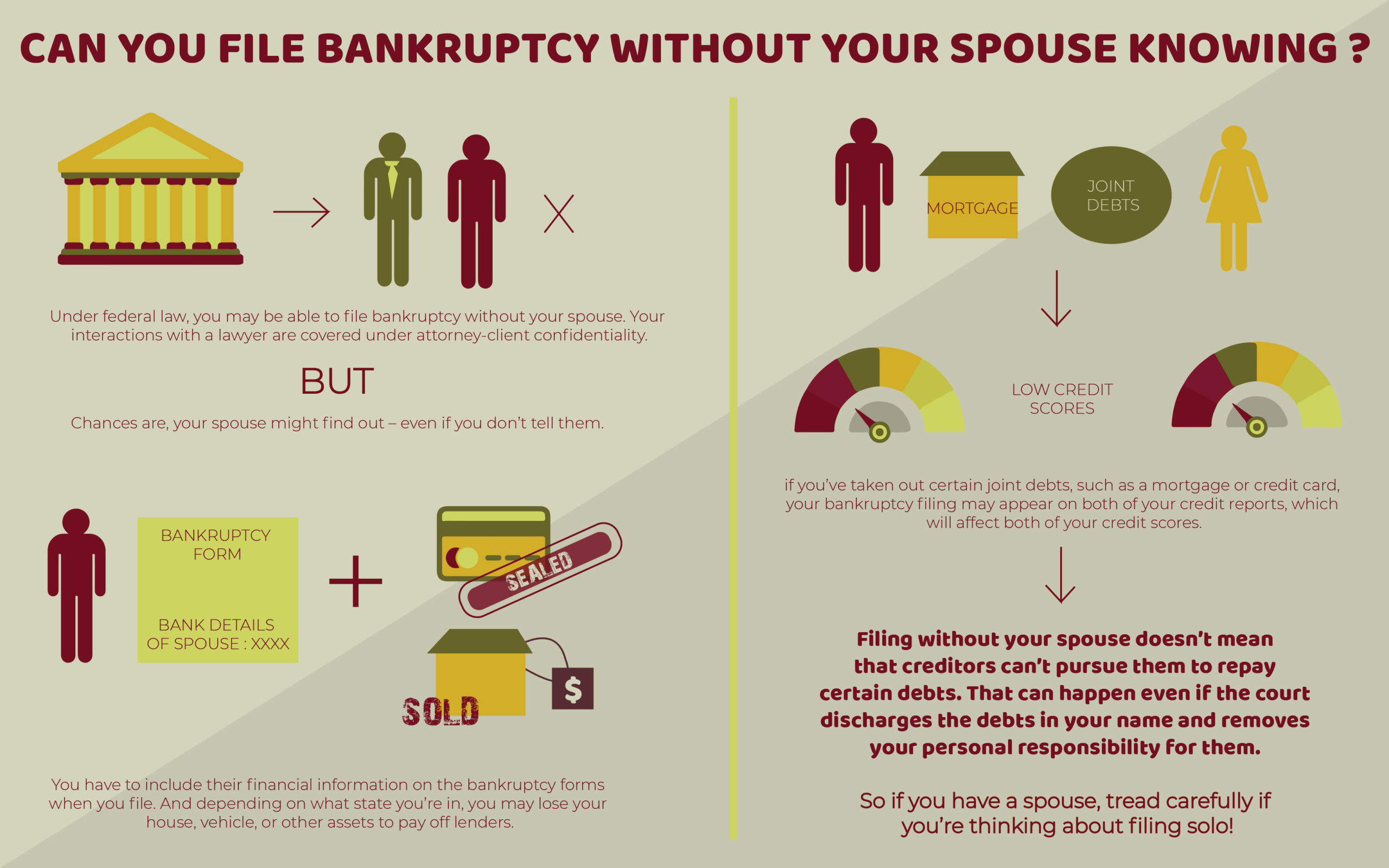

The financial obligation limits are detailed in the chart above, and present amounts can be confirmed on the United State Courts Phase 13 Personal bankruptcy Essential webpage. Discover more concerning The Method Examination in Phase 7 Insolvency and Financial Debt Limits for Phase 13 Personal bankruptcy. If you are wed, you can submit for bankruptcy collectively with your partner or independently.

Filing insolvency can aid a person by disposing of financial debt or making a plan to pay off financial debts. A bankruptcy instance generally starts when the debtor files a request with the insolvency court. There are various kinds of bankruptcies, which are usually referred to by their chapter in the United state Personal Bankruptcy Code.

Filing insolvency can aid a person by disposing of financial debt or making a plan to pay off financial debts. A bankruptcy instance generally starts when the debtor files a request with the insolvency court. There are various kinds of bankruptcies, which are usually referred to by their chapter in the United state Personal Bankruptcy Code.

If you are facing economic obstacles in your individual life or in your organization, opportunities are the idea of declaring insolvency has actually crossed your mind. If it has, it likewise makes feeling that you have a whole lot of bankruptcy inquiries that need responses. Many individuals actually can not address the question "what is personal bankruptcy" in anything except basic terms.

Lots of people do not realize that there are a number of sorts of bankruptcy, such as Chapter 7, Chapter 11 and Chapter 13. Each has its benefits and challenges, so knowing which is the most effective option for your present situation as well as your future recovery can make all the difference in your life.

Phase 7 is described the liquidation personal bankruptcy phase. In a chapter 7 insolvency you can eliminate, wipe out or discharge most types of debt.

The smart Trick of Bankruptcy Lawyer Tulsa That Nobody is Talking About

Numerous Phase 7 filers do not have much in the method of assets. Others have houses that do not have much equity or are in severe need of fixing.

The quantity paid and the period of the strategy depends upon the borrower's home, typical earnings and costs. Lenders are not permitted to seek or keep any kind of collection tasks or lawsuits during the case. If effective, these creditors will certainly be erased or official statement released. A Phase 13 personal bankruptcy is really effective because it offers a mechanism for debtors to avoid repossessions and constable sales and quit repossessions and utility shutoffs while capturing up on their safeguarded financial debt.

It gives the debtor the possibility to either market the home or end up being caught up on mortgage repayments that have fallen back. A person submitting a Phase 13 can suggest a 60-month plan to heal or come to be existing on home loan payments. As an example, if you fell back on $60,000 well worth of home mortgage repayments, you can suggest a strategy of $1,000 a month for 60 months to bring those home loan payments current.

It gives the debtor the possibility to either market the home or end up being caught up on mortgage repayments that have fallen back. A person submitting a Phase 13 can suggest a 60-month plan to heal or come to be existing on home loan payments. As an example, if you fell back on $60,000 well worth of home mortgage repayments, you can suggest a strategy of $1,000 a month for 60 months to bring those home loan payments current.

Not known Factual Statements About Chapter 7 Vs Chapter 13 Bankruptcy

Occasionally it is better to prevent bankruptcy and settle with financial institutions out of court. New Jersey also has an alternate to personal bankruptcy for services called an Job for the Benefit of Creditors (Tulsa OK bankruptcy attorney) and our law practice will certainly go over this alternative if it fits as a potential method for your organization

We have actually created a tool that helps you select what chapter your data is more than likely to be submitted under. Go here to make use of ScuraSmart and discover out a possible solution for your debt. Lots of people do not realize that there are a number of sorts of insolvency, such as Chapter 7, Chapter 11 and Chapter 13.

The Ultimate Guide To Bankruptcy Attorney Tulsa

Here at Scura, Wigfield, Heyer, Stevens & Cammarota, LLP we take care of all kinds of bankruptcy situations, so we have the ability to address your personal bankruptcy inquiries and assist you make the most effective choice for your instance. Here is a short check out the debt alleviation alternatives offered:.

You can just declare insolvency Before declare Chapter 7, a minimum of among these ought to hold true: You have a great deal of debt income and/or assets a lender could take. You lost your vehicle copyright after being in a mishap while uninsured. You need your permit back. You have a lot of financial debt close to the homestead exception quantity of in your home.

Hanson & Hanson Law Firm, PLLC

Address: 4527 E 91st St, Tulsa, OK 74137, United StatesPhone: +19184090634

Click here to learn more

The homestead exception quantity is the greater of (a) $125,000; or (b) the region mean list price of a single-family home in the coming before schedule year. is the amount of money you would keep after you sold your home and settled the mortgage and other liens. You can discover the.

Comments on “Not known Facts About Chapter 7 Bankruptcy Attorney Tulsa”